Old_Me

Emissary

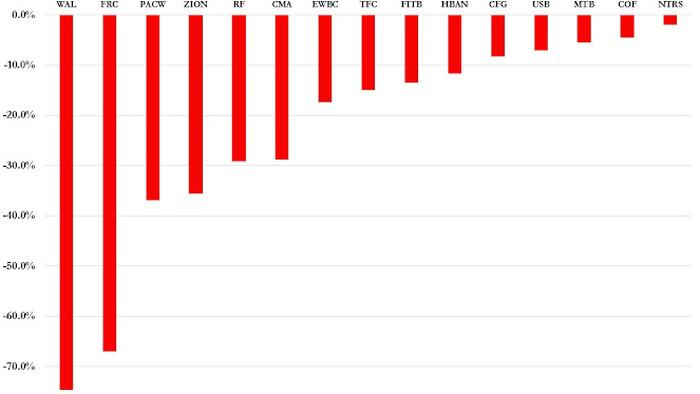

may not effect many of us, but still a large bank failure all the same...

Very bad déjà vu fines coming from this. 2008 affected everyone regardless if they “felt” it.Reminds me of 2008, I hope not that bad.

In 2008 25 banks failed, 5 were in California.

And this is who Saule Omarova is:The OCC, an independent branch of the U.S. Department of the Treasury, charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks.

That’s another way of saying she want to nationalize banks, which is as commie as it comes.President Biden’s controversial pick to be the Treasury Department’s comptroller of the currency is a USSR-born and educated professor who has praised the former Soviet Union’s lack of a gender pay gap while recently advocating for ending banking “as we know it” by moving Americans’ finances from private banks to the Federal Reserve.

In an early 2021 paper titled “The People’s Ledger,” Omarova argued for making private banks “non-depository lenders,” changing banking “as we know it.”

“Banks, in other words, will not be ‘special’ any more,” she wrote, advocating for separating their lending function from their monetary function.

Currency and lending are the engines of capitalism. Why would any sane person try to put a communist in charge of these things? Oh wait, I just answered my own question: because Joe Biden is a lunatic.In 2019, she posted to Twitter in support of the “old USSR” where there was “no gender pay gap.” She attempted to do damage control after being criticized for it, but failed to fully condemn the Soviet Union.

“I never claimed women and men were treated absolutely equally in every facet of Soviet life. But people’s salaries were set (by the state) in a gender-blind manner. And all women got very generous maternity benefits. Both things are still a pipe dream in our society!” she wrote.

i think so as well..I think the panic and withdrawing money from accounts will cause many more to come crashing down...

This whole thing seems planned... Bank collapsed Friday, auction, HSBC (Chinese bank) buys by Monday morning.i think so as well..

everyone keeps hearing about the oncoming inflation, the spikes from the feds increasing interest rates, and this will create wide spread panic.